Selfhelp was founded in 1936 to help Jewish refugees fleeing Nazi Germany. Today, Selfhelp has grown into a large human service and housing provider, providing care to older adults across New York City and Long Island. In its senior affordable housing residences, the organization uses an innovative model of care, called the Selfhelp Active Services for Ageing Model or SHASAM, that emphasizes the social determinants of health and has been found to help significantly improve health outcomes. Throughout the pandemic, the SHASAM proved to be vital in equipping Selfhelp to be well prepared to assist its residents, giving them the tools they needed to ensure resident safety during the pandemic and maintain as much normalcy amidst the uncertainty.

The National Housing Conference spoke with Selfhelp Realty Group| The Melamid Institute for Affordable Housing Vice President, Housing Services, Mohini Mishra, to learn more about how the organization adapted its practices and helped ensure compliance with pandemic restrictions, all while retaining resident autonomy.

Tell us about the communities you serve. Who are your residents and where do they come from?

Selfhelp was founded to serve Jewish refugees from Nazi Germany, who in the 1930s were arriving in New York en masse and had very little social capital to find their footing. Initially, our organization focused on providing job training and referrals for housing to emigres. However, as the population we served began to age, we decided to begin providing housing to older adults ourselves, and we opened our first residential building in 1964. That building was initially built for Holocaust survivors, but in order to ensure our eligibility for federal funding under the 1965 Older Americans Act, we opened our buildings to all seniors in need shortly thereafter.

Today, we operate 14 senior buildings with 1,400 residents ranging in age from 62 to 105. Our residents are extremely diverse, with only 10% speaking English as their first language, and large populations of Chinese, Korean and Russian speakers. Throughout Selfhelp, we provide Holocaust survivor services, home care training, home care, guardianship services and operate several senior centers (including a virtual one for homebound seniors), services that reach over 20,000 people a year.

Selfhelp uses a service provision model called SHASAM. Can you explain what this model entails?

At the foundation of the SHASAM model is the finding that 80% of a person’s well-being is determined by things that happen outside a clinical setting – a person’s social determinants of health – and that perhaps is the most important social determinant of health is social connection. Accordingly, SHASAM focuses on maintaining a social connection for the seniors in our buildings and ensuring that they are able to remain in our buildings no matter what health issues they encounter as they age. Our social workers are key to this model. They work on-site at each of our buildings and work to facilitate connection among our residents by organizing activities like walking clubs and mahjong classes.

Our social workers also work to build community among residents by connecting new move-ins with resident leaders who share a similar cultural and linguistic background. We know that it is vitally important for people to have access to culturally affirming goods, services and relationships, so we take very seriously the task of connecting new residents with people who can show them grocery stores that carry products they will be familiar with or places to access faith services they might be interested in.

Of course, we also recognize the importance of clinical care, and we provide referrals to healthcare services to all of our residents, as well as all of the social services already described. The key for us is that our residents always feel that they are able to choose whether to access these services, rather than have them foisted upon them and that no matter their level of need they are always able to stay in our buildings where they have built connection and community. We refer to this as ensuring that residents are allowed to age on pace, as well as age in place. A recent research paper, funded by NHC member JPMorgan Chase, found that Selfhelp residents experienced better health outcomes and submitted fewer claims to Medicaid and Medicare than comparable groups, affirming the success of our model and contributing to the growing literature on the effectiveness of housing and community for health outcomes.

One of our points of pride is that less than 2% of our residents are transferred to nursing homes during any given year. On Long Island, it costs on average $143,000 a year to keep one person in a nursing home and provide the clinical care that determines 20% of their overall wellness. That is almost exactly how much the SHASAM model would cost, which would include one of Selfhelp’s onsite social workers, who coordinate access to the social determinants of health that determine 80% of wellness and do it for an average of 80 residents. The fact that less than 2% of our residents move from our buildings to institutionalized settings in any given year is a testament to our ability to provide for their clinical needs while keeping them in the communities they love.

How did the SHASAM model fare during COVID-19?

At the core, the SHASAM model is one based on building trust, both among residents and between residents and Selfhelp employees, especially our onsite social workers. That trust proved invaluable when the pandemic hit and made it necessary to coordinate the activities of our residents in a way that would minimize risk for all of them. We all remember how confusing it was at the beginning of the pandemic; how unclear it was what was safe and what wasn’t, and how guidance on masks seemed to change with the week. That confusion was all the more acute for our residents, who knew they were at higher risk of developing complications from the virus and who often do not have access to traditional media sources due to language barriers. That sort of confusion could have generated mistrust and suspicion, but thanks to the trust we had built with our residents, we had the credibility to ask them to take the extraordinary measures that were necessary to keep everyone safe during the first several months of the pandemic and provide them with information they knew they could trust.

At the beginning of the pandemic, our social workers were in constant communication with each of our residents in order to break down the most recent CDC guidance and answer questions they had about new safety protocols, such as lockdowns and the closure of common areas. We also partnered with nursing students who were able to answer resident questions that were more healthcare or science-specific, as well as occupational therapy students who were able to answer questions about stress management.

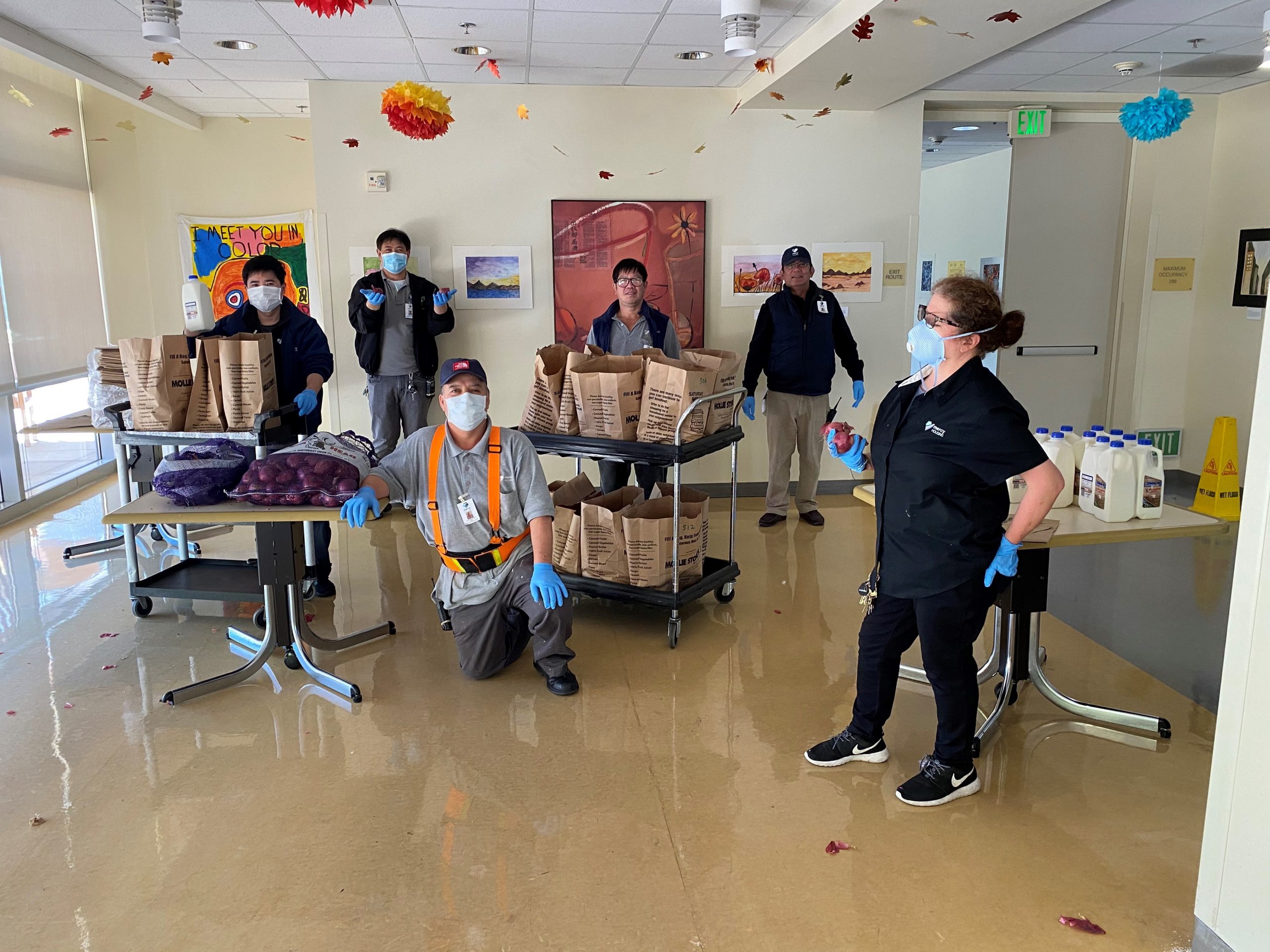

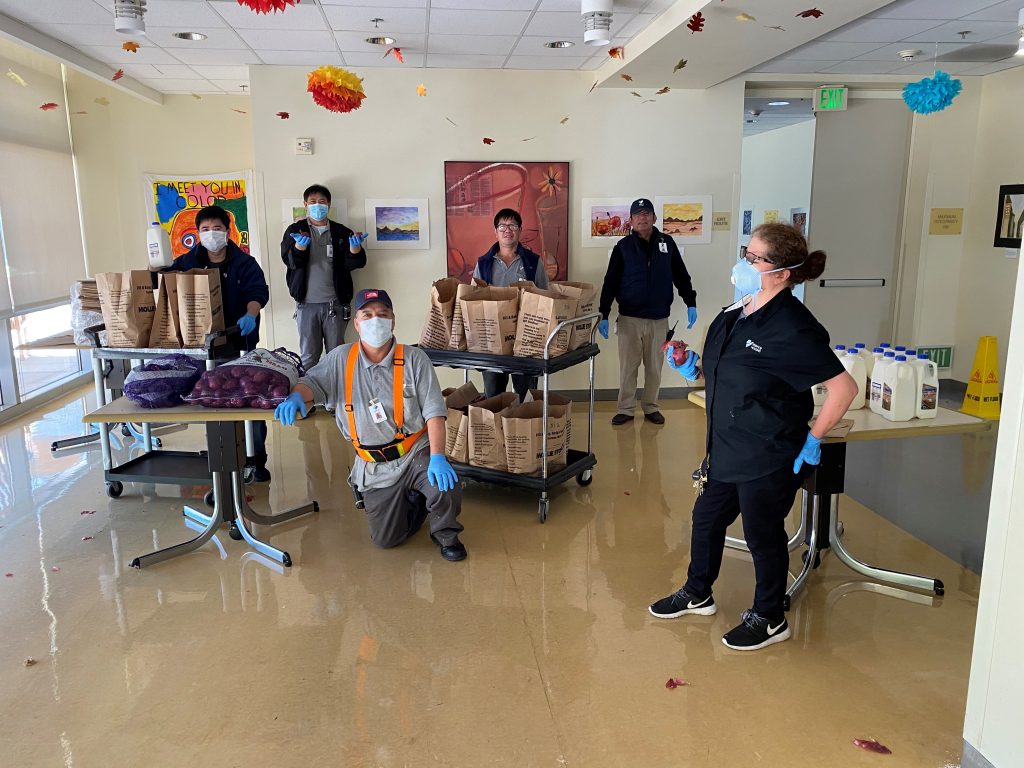

Our residents’ trust in our staff was also crucial in ensuring that they were connected with the sorts of services that were necessary during the pandemic. It can be difficult for many people to admit when they need help, and so the culture of trust and vulnerability that we have cultivated helped us ensure that no one went without during this time. For example, going into the pandemic we knew that 55% of our residents did not have home care aides who would have helped them with meal preparation and purchasing food. As local grocery stores started to close and residents began to avoid higher-risk activities such as shopping for food, we were able to connect residents who needed it with nutritional assistance services. This effort allowed 100% of our residents to receive some sort of nutritional assistance during the pandemic.

Throughout the pandemic, we have emphasized that social distancing is something of a misnomer. What’s required to beat the pandemic is physical distance, but physical distance need not entail a decrease in social connection at all. To that end, we worked hard to make sure our residents stayed connected with us and with each other during the pandemic, such as through creating a virtual happy hour for residents and leveraging existing virtual infrastructure that we used to provide services to homebound seniors before the pandemic. Again, it’s only because of our residents’ high level of trust in us that we were able to get them engaged in these sorts of activities and keep them healthy.

We’ve heard from other senior living providers that it was initially hard to communicate with residents when we entered lockdown, since face-to-face interaction was limited and many residents found it difficult to communicate using cell phones or the Internet. Did Selfhelp encounter similar challenges?

The key thing to understand about our SHASAM model is that it entails frequent communication with each of our residents no matter what. That means that despite some obvious changes to our work during the pandemic – staff being remote, coordinating lockdown procedures, etc. – the communication aspects of our work didn’t change all that much. We were already in consistent communication with our residents, and we had already ensured that we could get in touch with each of them remotely were there to be an emergency that prevented us from being on-site, such as a hurricane or blizzard.

We have also cultivated a network of resident volunteers in each of our buildings, who help keep us updated on the well-being of their neighbors. Though we had to coach them a bit on how to go about checking up on their neighbors while limiting face-to-face contact, having that network in place made it far easier for us to ensure all our residents remained safe and healthy even when we had trouble getting in touch with them remotely. If we hadn’t been able to contact a given resident in a few days, we could always call our dedicated resident volunteers. Nine times out of 10, that person would say that they’d seen that resident in the laundry room or walking down the hall a few days ago, and that they seemed just fine. The biggest difference during the pandemic is that we used these sorts of remote capabilities for far longer than we ever had before.

How did the SHASAM model help to facilitate vaccine uptake?

The SHASAM model emphasizes self-determination, and so we have been careful to emphasize that vaccination is a personal choice that each of our residents needs to make for themselves. This framing is especially important for our clients, because many of them come from backgrounds that make them skeptical of government-sponsored health initiatives, and so attempting to force or pressure them into getting the vaccine would erode their trust in us and probably be ineffective at increasing vaccine uptake anyway.

That being said, we have tried to leverage our residents’ trust in us to act as a dependable source of information on the vaccine, just as we did during the beginning of the pandemic when we acted as a trusted source of information on CDC guidance. We’ve been discussing the vaccine with residents since October of last year, letting them know that vaccines were coming and that we were available to answer any questions they might have about it.

Another way we increased resident vaccine uptake without coercion was by creating a vaccination site by partnering with a federally qualified health clinic located on the first floor at one of our buildings. Having a vaccination site at one of our properties helped increase residents’ trust in the vaccine since it no longer seemed like something a far-off government was pushing but rather something that was in collaboration with Selfhelp, an organization our residents trust. Using these sorts of methods, we were able to get our vaccine acceptance rate above 80%. While some might be skeptical of the fact that we got to that number by emphasizing the voluntary nature of getting vaccinated, we think it makes perfect sense: people respond best to being treated as capable and intelligent, and since the balance of the evidence is on the side of getting vaccinated, we knew that simply presenting the pros and cons of vaccination to our residents and allowing them to make their own decision was the best route forward.

How is Selfhelp taking concrete steps to actualize the lessons it learned from the pandemic?

We think that the pandemic proved the effectiveness of SHASAM’s emphasis on using housing as a base to provide services to people, rather than changing people’s housing depending on the sorts of services they need. We think that this affirmation of our model’s success is a great reason to look to expand, and so to that end, we have created an affiliate entity called Selfhelp Realty Group, that focuses on efforts to build more senior affordable housing. Building off the success engendered by the research paper on our model, we have also leveraged funding from Holocaust survivor Ilse Melamid to enhance these efforts through the Melamid Institute for Affordable Housing, which will help us spread our model by growing our capacity in New York and beyond. The institute will act as the primary entity for development, building Selfhelp Realty Group’s capacity to pursue real estate opportunities and Selfhelp’s administrator’s ability to provide services to residents in existing buildings. The Institute will ensure we are able to continue what we do best while spreading the word about our approach and expanding our ability to provide services to the population we serve.